Is rental property in the UK volatile for investment?

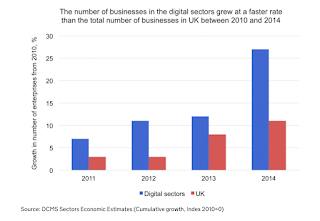

When we speak of volatility we are referring to the degree of variation in an asset when it’s price fluctuates. The calculation to measure this is usually done by calculating standard deviation, which helps quantify the variance. The most well known associations of these patterns are often seen in the financial markets whose multiple peaks and troughs look like epic mountain ranges. Amongst analysts the belief is long-term movements generally remedy any short term losses. For example if we look at the Land Registry Average House Price Index below from Oct 2007 to Aug 2017 we can see the after the property crash of 2007 the tenancy deposit claim birmingham house price index fell from 70.51 (Oct 2007) to 61.57 (Jan 2009) a fall of 12.7%. However in the long term between Oct 2007 (70.51) and Aug 2017 (116.89) the house price index rose overall by 65.7%, which shows the short term annual fluctuations although showing drops in value in the long term, ...