Will we be using cryptocurrency to purchase property in the near future?

This is the first part of a series of blog posts that will be looking into the phenomenon of cryptocurrency. Will it be changing the face of finance and the way we purchase property in the future?

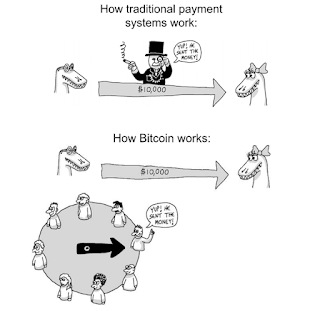

On 3 January 2009, the then Chancellor Alistair Darling was considering the second bailout of the banks after the financial crash of 2007-08. At the same time a little known programmer identifying himself under the pseudonym of Satoshi Nakamoto brought his online digital currency masterpiece to life. It was called Bitcoin, a decentralised medium of exchange and store of wealth that uses cryptography to control its creation and management. History was being made, Nakamoto’s vision was to remove power from the corrupt banks and governments and give power back to the people. It would be using a system called “blockchain” which enabled “peer-to-peer” transactions of currency between two parties to take place. This design enabled spending to take place without the use of a central party.

Three months prior on 1st of November 2009, Nakamoto proposed his idea to a group of renowned mathematicians, cryptographers and statisticians. They said it would not work and its feasibility in terms of scaling and resources was not possible.

8 years later Bitcoin has caused a storm in the financial world and the media. From its humble beginnings with initial opening price of $0.06, it has grown exponentially to a store of wealth that is valued today at $5,895.30, an increase of 9,825,400% since it’s inception.

The scandals of its use in the “Silk Road” online market scandal (fuelled by the benefit of anonymity in transactions using this technology) for illicit transactions has done little to stop interest in this new medium, as a growing number of millionaires out of a new crypto-literate elite are taking their piece of the pie as we transition into a new digital age.

So how has this impacted the property market so far? A growing number of vendors in the UK property market have been putting their properties up for sale with the medium of Bitcoin as an accepted means of payment.

Using the Bitcoin “blockchain” mechanism as a digital ledger has the benefit of tracking assets securely, another bonus of this technology is that a property’s value can be broken down into virtual parcels that can then be traded on an exchange platform. Home owners will have the advantage of being able to unlock and sell up to 49% of their properties equity whilst retaining occupancy. This gives buyers a lower barrier of entry into property ownership, enabling them to potentially gain ownership for the purchase of 51% of a property’s value.

A company called “TrustMe” will be enabling home owners to use Bitcoins to trade shares (known as property certificates) in their property on the housing market. The first exchange of this type is due to take place in tenancy deposit claim London this month, due to the buoyant £2 trillion market and it’s well established property processes.

Those who try and brush off the trend as a fad will be interested to know that many emerging cryptocurrencies spurred since the introduction of bitcoin, have some very powerful investors (including a number of highly successful silicon valley participants) behind them. It has also attracted the attention of many major players in the banking system, who are trialling out crypto technology to improve the efficiency of their systems. The improvement in transaction efficiencies has been seen to save time, and time is money.

The next generation of emerging crypto currencies is another topic for future discussion in the same space.

Disclaimer: Any information given in this article should not be taken as investment advice, the crypto-currency market is a very volatile environment and many of the projections are speculative at best.

Comments

Post a Comment